LOST HORIZON INC.

50-550 Million Ounces of Gold. Plus Rare Earths. Documented by USGS. Nobody Can Reach It. Until Now.

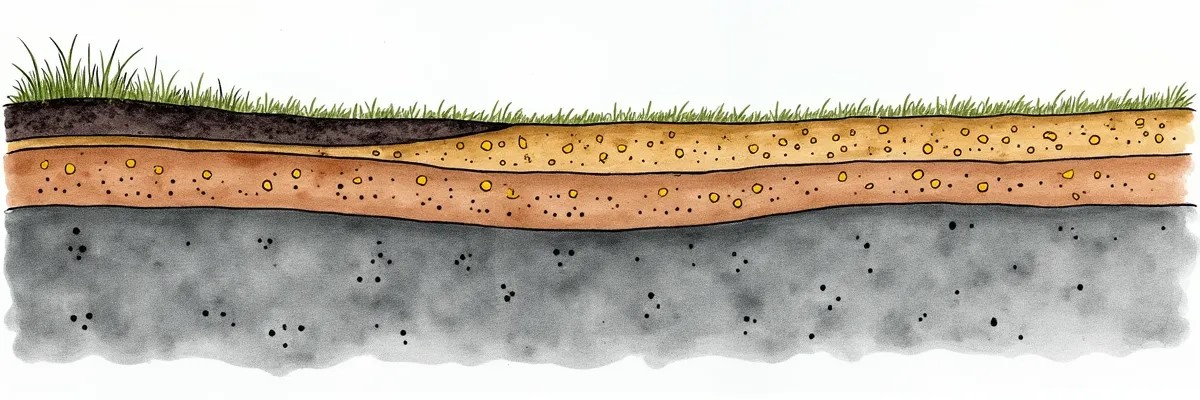

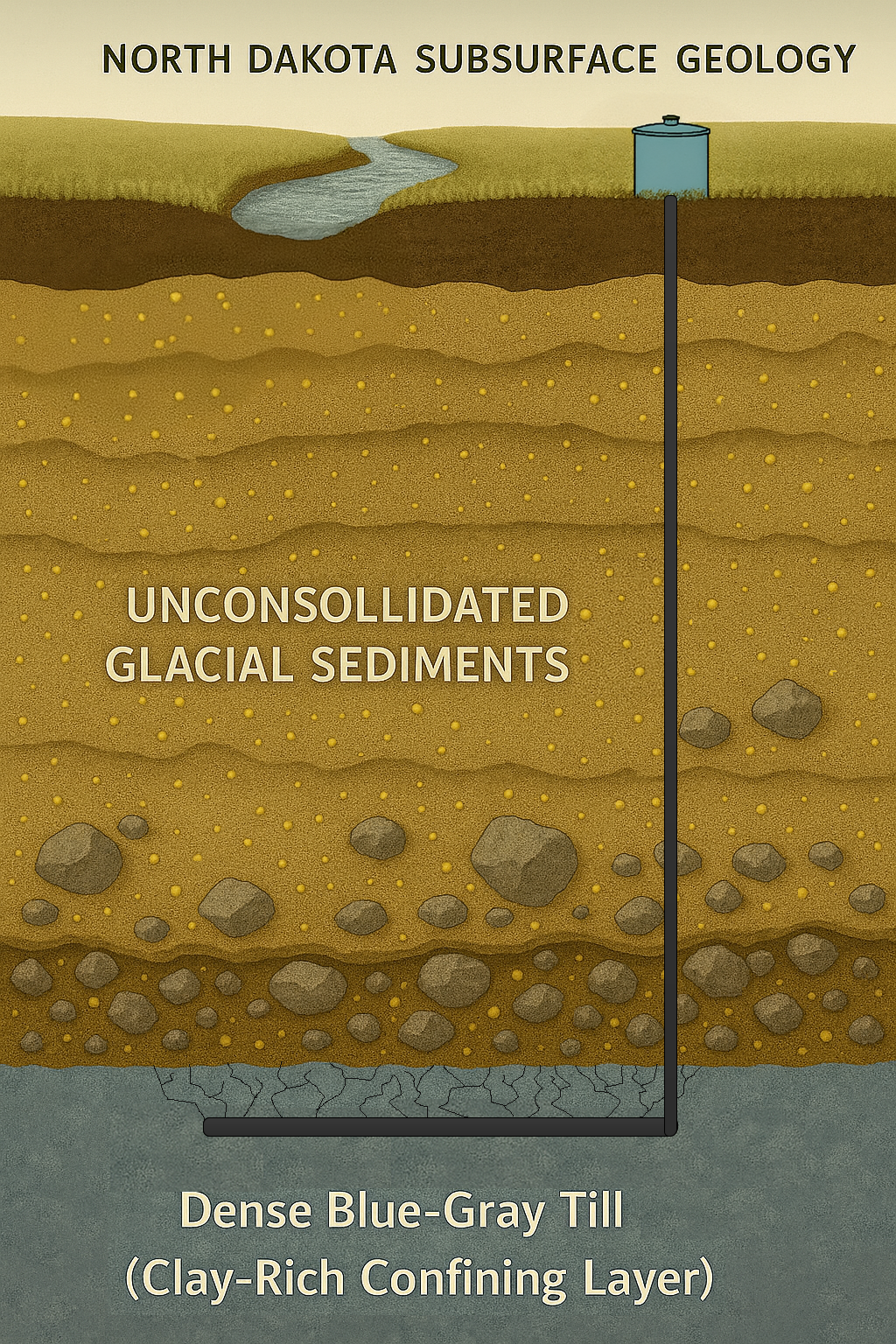

In the 1930s, government surveys found gold across 990 square miles of North Dakota. Depression-era miners confirmed it was there—but buried deep in water-saturated sediments that conventional mining couldn't touch economically. We're not digging it up. We're processing it underground. The formation becomes the separator. Only concentrated minerals come to surface.